If you wonder whether or not you should get a post-bankruptcy auto loan from a dealership, you're not alone. Most people with bad credit don't know where to turn to get the best rates on car financing. You want to get a safe and reliable car, without being taken for a ride.

If you wonder whether or not you should get a post-bankruptcy auto loan from a dealership, you're not alone. Most people with bad credit don't know where to turn to get the best rates on car financing. You want to get a safe and reliable car, without being taken for a ride.

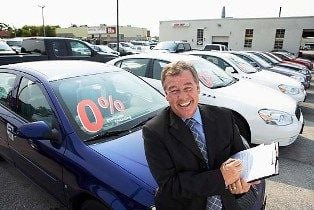

Getting a Loan from a Dealership

Getting a post-bankruptcy auto loan from a dealership can have some advantages. A dealership provides financing and cars in one location, which can be convenient. You can also negotiate the selling price of the vehicle, and the interest rate.

One major disadvantage is that finding dealers that accept bankruptcy clients can be difficult. Many dealerships don't offer bankruptcy auto financing, require huge down payments or require cosigners. You may find yourself getting turned down by several dealerships before finding one that will work with you.

Another disadvantage is that there is more pressure to buy right then when you get a loan through a dealership. Shady car salespeople will make you feel like you have to make a decision before leaving. Some will even manage to tack on extras that you might not otherwise agree to.

A Better Car Financing Option after Bankruptcy

There is a better car financing option after bankruptcy that you may not be aware of. This is using bankruptcy auto finance companies, such as BankruptcyAutoFinancing.com. We specialize in finding lenders who provide special financing for bankruptcy clients.

To get started, simply fill out our easy online application. You'll be able to see right away how much you could borrow. Then one of our loan experts will go over your application and contact you with your financing options.

You'll be matched with a local dealership that has a selection of cars, trucks and SUVs to fit your budget. When you drive off the lot, you'll have a great vehicle with affordable monthly payments. Plus you'll improve your credit, since all of our lenders report your on-time payments to the major credit bureaus.

Remember, we are not lawyers and cannot give legal advice. The situations discussed are only our experiences over the years and may vary with each customer.